The Weekend Update Is Now Available

The latest issue of the Iacono Research Weekend Update has been posted to the website and is now available for subscribers here. The executive summary is as follows:

Following another $713 billion in “backdoor” money printing by the European Central Bank, the Dow Jones Industrial Average soared above 13,000 and the Nasdaq climbed atop 3,000 before both indexes retreated amid concerns over the health of European economies and the combination of falling home prices and rising gas prices in the U.S.

Pump prices set yet another new record for this time of the year at more than $3.70 per gallon and a vicious sell-off in precious metals on Wednesday was triggered by a large gold futures contract liquidation that then led to a cascade of more selling. For the week, the model portfolio fell 2.8 percent and is now up 11.1 percent for the year.

More on Warren Buffett and Gold

Max Keiser talks to Ned Naylor Leyland of Cheviot Asset Management about why Warren Buffett hates gold after the “Oracle of Omaha” devoted a considerable portion of his recent shareholders letter(.pdf) to discuss why the metal is not worth owning.

Among the many other interesting things you’ll learn from Ned is that Warren Buffett’s father was the “Ron Paul of his day”, meaning that, Buffett the Younger’s views toward the yellow metal are likely something he didn’t learn at home.

The Model Portfolio Has Been Updated

It was a wild week for financial markets as energy prices surged and then fell while the gold price plunged nearly $100 after Federal Reserve Chief Ben Bernanke failed to mention the next round of quantitative easing when addressing Congress, triggering a massive sell order for gold futures.

For the week, the model portfolio fell 2.8 percent and is now up 11.1 percent for the year. Subscribers may view the latest update to the model portfolio here and, as always, the next issue of the Weekend Update will be available early Sunday morning.

Labor Market Not As Rosy As it Appears?

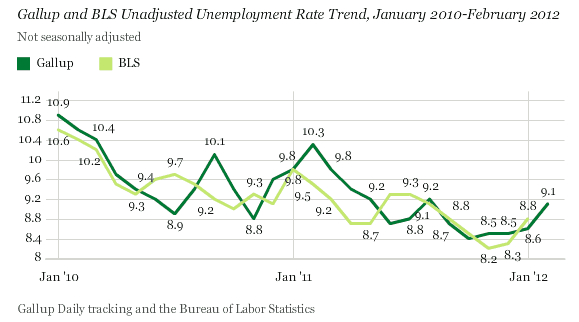

Well, next Friday’s labor report should be pretty interesting as more signs emerge that the U.S. economy is not quite as healthy as it looks due to an unusually warm winter and odd seasonal adjustment factors resulting from the 2008-2009 recession. The latest evidence comes in this Gallup unemployment survey that shows the jobless rate going back up in February

The differences between the adjusted/unadjusted and Gallup/BLS data are all rather complicated, but, one thing seems certain - the jobless rate as reported by the Labor Department is not going to go down again from its level of 8.3 percent in January. It could jump just a few tenths of a percentage point or to as high as 9 percent.

Negative Equity, Foreclosures in the News

Corelogic and RealtyTrac are really raining on the parade that is the U.S. economic recovery (and Secret Commerce Department Report Shows the Economy May be Faltering at the CEPR isn’t helping either) as both real estate data firms provided a sobering new look at the U.S. housing market that many analysts think is poised to rebound this year.

RealtyTrac released its final report on foreclosure activity in 2011 noting that distressed sales accounted for 24 percent of all sales in the fourth quarter, up from 20 percent in the third quarter, and that the average price of a foreclosure-related sale was 29 percent below non-foreclosure sales. Corelogic reported the latest data on negative equity below, a situation that is not likely to get any better with ongoing home price declines.

With nearly a third of all borrowers either in or near negative equity, we’ll be hearing a lot more on this subject during this election year as the banks’ foreclosure mills crank up again along with talk of (and a little action on) principal writedowns.

Iacono Research Subscriptions

as of Mar 2nd, 2012

| Week: | -2.8% | |

| Month: | -0.4% | |

| - | - | |

| 2011: | -5.3% | |

| 2010: | +27.6% | |

| 2009: | +15.5% | |

| 2008: | -27.4% | |

| 2007: | +23.9% | |

| 2006: | +25.4% | |

| - | - |

- Five Key Points on Buying a Short Sale September 15, 2010

- Now -That - Was a Gold Bubble October 20, 2010

- What if It Was All Just a Big Bubble? March 24, 2010

- The Weekend Update Is Now Available March 4, 2012

- More on Warren Buffett and Gold March 4, 2012

- The Model Portfolio Has Been Updated March 2, 2012

Think You Should Know The Price Of

![[Most Recent Exchange Rate from www.kitco.com]](../exrate/24hr-jpy-small.gif)

| National Debt Clock |

BLOG ROLL

Alfidi Capital

Bank Implode-O-Meter

Bernanke Panky

Bubble Meter

Bull! Not bull!

Calculated Risk

Capital Flow Watch

Capitalists@Work

Contrary Investors Cafe

Changing Places

Credit Writedowns

CrisisMaven's Blog

Crossing Wall Street

Decline of the Empire

Dollar Collapse

Dr. Housing Bubble

Earth Costs

Echo Boom Bomb

Econbrowser

Economist's View

Economic Disconnect

Economic Rot

Economic Populist

EconomPicData

Expected Returns

Financial Armageddon

Financial Sense Online

Fund My Mutual Fund

Gold Scents

Hedge Fund Implode

Home Builder Implode

Housing Doom

The Housing Bubble

Huffington Post

Implode-O-Meter (Original)

Jeff Matthews

Jesse's Café Américain

Juggling Dynamite

Kids Prefer Cheese

Laid Trades

Lansner on Real Estate

Liberated Stock Trader

Live Debt Free

Ludwig von Mises Institute

Mises Economics Blog

Manhattan Beach Confidential

Marginal Revolution

Market Observation

Minuteman Lobbyist

Mish

Models & Agents

Mover Mike

Naked Capitalism

The Nation

National Review Online

NJ Real Estate Report

OC Housing News

OilPrice.com

Paper Economy

Patrick.net

Professor Piggington

Prudens Speculari

PrudentBear

RealClearMarkets

RealClearPolitics

Robin Hood Trader

Rogue Economist Rants

SoCal RE Bubble Crash Blog

Safe Haven

Salon

Sense on Cents

Social Den

Staghounds

Survival and Prosperity

The Best Rates

The Big Picture

The Bonddad Blog

The Capital Spectator

The Great Depression of 2006

The Livermore Report

The Oil Drum

The Prudent Investor

Treatment Report

WallStreetOasis

Wall Street Mess

WTF Finance