Even More Gold Stories (from 2005)

[This will be the last of the items pulled from the archives as our trip to the East Coast has about come to an end. Originally published back on December 6, 2005 when the gold price had just broken through the $500 an ounce mark, this was the beginning of a spectacular three-fold rise in the gold price that coincided with the ongoing tenure of Ben Bernanke at the Federal Reserve. Within a few months, the gold price would be above $700 an ounce before correcting and, if the yellow metal were to paraphrase a non-English speaking sports star from decades ago, it might say, "Ben Bernanke has been bery, bery good to me".]

ooo

The mainstream financial media is cranking out the gold stories at an astonishing pace these days. It seems there is some sort of urgency to recognize the rising price and publish a few keen observations, perhaps some wry commentary, before the “barbarous relic” either falls quickly back down into the $400 range, or possibly takes off in the other direction.

Some economists are even writing about gold now. As a group, they are generally mum about number 79 in the Periodic Table of Elements, due to its irrelevance in their line of work. That may change, of course, but right now, only a few of them are talking about it - grudgingly.

For some economists, there is perhaps an inner compulsion to acknowledge gold’s rising price - a compulsion that now co-exists uncomfortably with the more instinctive response, that of wondering what all the fuss is about. Most economists say the same thing when they talk about gold - it’s as if there has been a set of talking points, in circulation since the days of John Maynard Keynes, a sort of trained response.

We’ll get to the economists in a couple minutes.

Gold Stories from Asia

The most interesting gold stories lately are not coming from the West, but rather from the East - Middle and Far. From a couple months ago, this Morgan Stanley commentary suggests that Asian central banks should be buying gold:

Gold is not really a good inflation hedge, but a decent hedge against the business cycle. We argue gold is a good hedge, or, more precisely a ‘neutraliser’, against currency risk.

This favours central banks holding more gold in their reserves to dilute their exposure to foreign currencies. First, the USD could falter and thus erode the USD value of the Asian central banks’ foreign reserve holdings. Second, the Asian currencies could appreciate leading to a valuation loss on official reserves. Gold holdings could partly ‘neutralise’ or dilute the first risk but can do little about the latter, especially if the country in question has low gold holdings. For the same reasons, petrodollar holders should also consider buying gold.

This story from the English version of the People’s Daily foretells the gold buying binge of Asian central banks:

Russia, Argentina and South Africa have decided this month to increase their gold reserves, which reversed the selling trend in six years by world central banks, especially European ones.

It is only a question of time for Asian central banks to follow and buy in gold: they hold 2.6 trillion US dollars in foreign exchange reserves, and able to change more of them into gold as a hedge against US dollar falls.

…

Asian countries have good reasons to hold more gold. Compared with developed countries, their percentages of gold in foreign exchange reserves are apparently small. As the World Gold Council pointed out, Asian investors are the world largest gold consumers, but gold only takes 1.1 percent in China’s official reserves, or 1.3 and 3.6 percent in Japan and India respectively. A sharp contrast is the American percentage of 63.8 percent, and over 50 percent in Germany, France and Italy respectively.

Now, there are many who would dispute the 63.8 percent number for the gold reserves in the U.S. central bank. Think about it a minute - the whole reason the gold window was closed in 1971 was that the French, among others, were rapidly depleting the U.S. supply of gold bars to settle international trades during Johnson’s guns and butter years.

If indeed it is still there, Mark Cuban asks an excellent question - why not sell it?

It has clearly outlived its usefulness and the U.S. government has many debts to square. In his final congressional testimony last month, Rep. Ron Paul asked Fed Chairman Alan Greenspan the same question, to which The Maestro replied, “We might need it in a time of crisis.”

Hmmm…

Gold Stories from the Mainstream Media

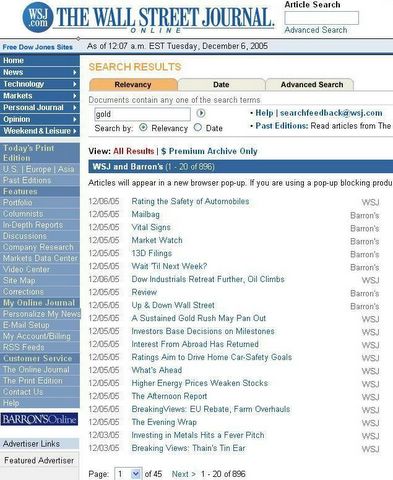

What does the mainstream financial media think? Well, this screen shot of a Wall Street Journal / Barron’s online article search for “gold” provides an idea:

Not all of these are about element 79, as there are gold and silver auto safety awards to dole out and those Goldman Sachs bonuses have been in the news, but gold does seem to be getting lots of attention. And, look what was in the mailbag from a Mr. Paul Yusem of Illinois:

In the Nov. 21 Up & Down Wall Street column, “Plethora of Bulls1,” Alan Abelson asks, “What’s got into gold?” He offered several factors for the rise in gold prices, including huge trade and fiscal deficits, the fragility of paper money, economic woes and inflation.

A possible trigger for the recent gold rally might be the announcement by the Federal Reserve that it will discontinue publication of data on M3 and repurchase agreements. M3 has been published by the Fed since at least 1960 and is a pretty good predictor of inflation over the long term. Repurchase agreements show the Fed adding or draining liquidity from the financial system. The sudden announcement that these figures will no longer be published probably contributed to the gold rally.

…

But the overriding factors are supply and demand. Since demand exceeds mine supply plus scrap, gold prices have been rising. The central banks have been selling and leasing gold for years to contain the price rise. However, the gold market has finally entered a major inflection point.

Mr. Yusem seems to be well informed - either that or he’s crazy. Or, maybe crazy like a fox. A well informed crazy fox is our bet.

The BBC had a nice story about gold yesterday:

“The overall feel in the market at the moment is of diversification away from the US dollar and other currencies into gold and also from shares into gold,” said a trader in Singapore.

…

“There was a significant drive in Japan in recent weeks,” said Darren Heathcote of NM Rothschild. “People are very happy to be jumping on the bandwagon and basically riding the thing up.”

…

There is also speculation that Asian central banks will cut their US dollar holdings - which have been boosted by export sales - and increase gold stocks.

Robert Samuelson heralds the return of the gold bugs and the possibility of many more in Asia, with this story appearing in the December 12th issue of Newsweek:

Though new mines often require a decade to bring into production, supply could ultimately overtake demand. Or prosperity in India and China might multiply by many times the world’s gold bugs. They may regard gold as a more trustworthy form of saving than any currency, even though gold investments don’t pay interest or dividends. Whatever happens, the fears and anxieties that give gold its speculative appeal could intensify or dissipate. Gold is an unending mystery, because its value lies less in what it does for us (it is not like sugar, copper or oil) and more in what it symbolizes. It is almost as unfathomable as the human drama itself.

Be on the lookout for the Time Magazine cover. If this honor portends for gold what it did for the housing bubble a few months back, that will be the signal to gather up all those American Eagles, Canadian Maple Leafs, and South African Krugerrands and start calling coin shops.

And Finally, Gold Stories from Economists

So, what do economists think? Last week one of The Economist’s economists suggested that even at $500, the little yellow metal is still a little old and barbarous:

This being gold, the resurgence has brought forth all manner of alarming prophecies. The price is an omen of rampant inflation; bonds are doomed; the dollar is about to fall prey to the United States’ reckless deficits; the euro will shortly be revealed as a worthless creation of bureaucrats.

The world is an unpredictable place. But, with the possible exception of a fall in the dollar, not much of the above catalogue of doom looks likely; and none of it has much to do with gold’s good run. The dull truth is much less bullish for gold. Investors have put money into a wide range of metals, and precious metals’ prices, including gold’s, have risen with the base. Meanwhile, gold remains fundamentally unattractive. It yields nothing and central banks are sitting on vaultfuls of the stuff that they want eventually to sell. Gold bugs hope that $500 is the threshold at which mainstream investors will start once again to take an interest in the metal. Caveat emptor.

…

Gold is still cheap compared with its peak of $850 in 1980. Today, adjusting for changes in American consumer prices, it is worth only a quarter as much. Gold bugs might see that as a chance to buy; others as a reminder of gold’s enduring capacity to disappoint.

This neatly covers all the arguments against gold as an investment - inflation is under control, the global imbalances can be managed, gold pays no interest, and most importantly, gold is irrelevant because all the world’s central bankers and economists are firmly in control.

Apparently, the only thing left out here are the benevolent actions of Western central banks toward the world’s mining industry in not selling all of their gold.

James Hamilton at Econbrowser concurs:

Besides, other investments that appreciate with inflation also generate income for you while you’re waiting for the capital gain- real estate yields rent, corporate stocks pay dividends, inflation-indexed Treasuries give you a coupon. But gold you can only look at.

…

Fed Chair Paul Volcker’s determination to eliminate inflation proved to be a disaster for the gold bugs. And today’s Fed looks to me even more committed than Volcker was to preventing even the smallest whiff of inflation.In any case, if you did want to bet on inflation, there are better vehicles out there for doing so, such as going short 10-year bonds and long on inflation-indexed securities.

Yes, the inflation battle has been won - just don’t tell that to a middle class family of four who find it necessary to borrow against their home to make ends meet. That is, if they were lucky enough to be able to purchase a home a few years back, before housing prices started rising at five to ten times the rate of “inflation”.

And, as for central banks raising interest rates to double digits to contain inflation, that went out with the Rubik’s Cube and Paul Volcker in the 1980s. The squealing sound will be deafening if short term rates are pushed much higher than they are today. Does anyone really think that this country can handle 1980s style tough love with the amount of government, corporate, and personal debt that exists today?

In partial defense of Professor Hamilton’s comment about only being able to look at gold - this is not necessarily a bad thing. It is beautiful to look at.

Over at Wikipedia, among many other things, including a beautiful picture of gold bars against a blue background, they have this to say about gold as an investment. Specifically, how inflation (reported, perceived, or otherwise) is one of the many factors influencing the price of gold:

Most paper currencies which ever existed have been inflated out of existence. Even the very few which have survived a hundred years or more, have seen almost all of their value eroded by the printing of paper money, or the inflation of the money supply. Rising prices, known as inflation are a symptom of the inflation of the money supply. In times when inflation is high, or is expected to be high, because it is rising, people seek protection through holding real assets rather than fiat money, which can be printed ad infinitum. History is littered with examples of currencies which have collapsed in hyperinflation. Gold, which is a real asset, can never be printed by any government, nor is it a claim against any creditor. The demand for gold rises in inflationary times, pushing up the gold price.

Do economists read Wikipedia?

If so, it is natural to wonder what they think of the treatment of such topics as inflation, fiat money, and gold, the content not being written exclusively by economists.

Leave a Reply Click here to cancel reply.

Iacono Research Subscriptions

as of May 25th, 2012

| Week: | +0.2% | 2009: | +15.5% | |||||

| Month: | -5.3% | 2008: | -27.4% | |||||

| Year: | -1.1% | 2007: | +23.9% | |||||

| 2011: | -5.3% | 2006: | +25.4% | |||||

| 2010: | +27.6% | 2005: | +21.9% |

- Five Key Points on Buying a Short Sale September 15, 2010

- Now -That - Was a Gold Bubble October 20, 2010

- What if It Was All Just a Big Bubble? March 24, 2010

- The Weekend Update is Now Available May 27, 2012

- The Weekend Update - May 27th, 2012 May 27, 2012

- Even More Gold Stories (from 2005) May 25, 2012

Think You Should Know The Price Of

![[Most Recent Exchange Rate from www.kitco.com]](../../../exrate/24hr-jpy-small.gif)

| National Debt Clock |

BLOG ROLL

Alfidi Capital

Bank Implode-O-Meter

Bernanke Panky

Bubble Meter

Bull! Not bull!

Calculated Risk

Capital Flow Watch

Capitalists@Work

Contrary Investors Cafe

Changing Places

Credit Writedowns

CrisisMaven's Blog

Crossing Wall Street

Decline of the Empire

Dollar Collapse

Dr. Housing Bubble

Earth Costs

Echo Boom Bomb

Econbrowser

Economist's View

Economic Disconnect

Economic Rot

Economic Populist

EconomPicData

Expected Returns

Financial Armageddon

Financial Sense Online

Fund My Mutual Fund

Gold Scents

Hedge Fund Implode

Home Builder Implode

Housing Doom

The Housing Bubble

Huffington Post

Implode-O-Meter (Original)

Jeff Matthews

Jesse's Café Américain

Juggling Dynamite

Kids Prefer Cheese

Laid Trades

Lansner on Real Estate

Liberated Stock Trader

Live Debt Free

Ludwig von Mises Institute

Mises Economics Blog

Manhattan Beach Confidential

Marginal Revolution

Market Observation

Minuteman Lobbyist

Mish

Models & Agents

Mover Mike

Naked Capitalism

The Nation

National Review Online

NJ Real Estate Report

OC Housing News

OilPrice.com

Paper Economy

Patrick.net

Professor Piggington

Prudens Speculari

PrudentBear

RealClearMarkets

RealClearPolitics

Robin Hood Trader

Rogue Economist Rants

SoCal RE Bubble Crash Blog

Safe Haven

Salon

Sense on Cents

Social Den

Staghounds

Survival and Prosperity

The Best Rates

The Big Picture

The Bonddad Blog

The Capital Spectator

The Great Depression of 2006

The Livermore Report

The Oil Drum

The Prudent Investor

Treatment Report

WallStreetOasis

Wall Street Mess

WTF Finance

No comments yet.