|

|

Investment Approach Overview The approach to investing offered here is, at first glance, pretty simple - buy and hold commodities, shares in natural resource companies, and other similar assets for the duration of the natural resources bull market, making relatively minor adjustments along the way. Why is it only simple at first glance? The word "buy and hold" convey a sort of safe, passive approach to investing with which many people may be familiar, based on experience with their retirement savings accounts. Retirement accounts typically contain stock and bond mutual funds from large investment companies like Fidelity or Vanguard and, like their peers, people select from the limited options provided in their plan. Everyone picks from the same funds - as you get older, you go heavier on the bonds, and lighter on the stocks. "Buy and hold" as applied to natural resources sector investments is different from "buy and hold" in your retirement savings plan in three very meaningful ways:

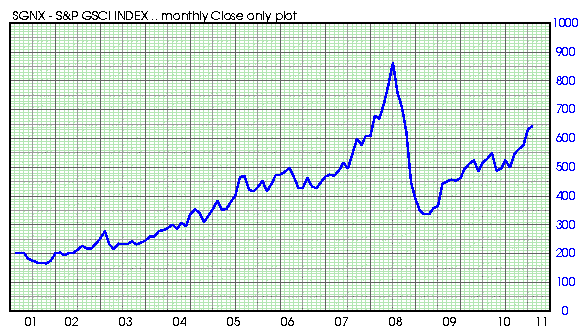

Many a newcomer have been "shaken out" of investments in such things as oil and gold by violent corrections and, after the events of 2008 and 2009, this is entirely understandable - commodities have become even more volatile than usual in recent years. When looking at the last ten years of commodity prices as shown in the S&P GSCI (Standard & Poor's Goldman Sachs Commodity Index) chart below, the trend was very clear up until the financial market meltdown of 2008 when nearly all asset classes were sold off. It has taken some time for commodity prices to recover, providing great entry points for new purchases in the process, but there should be no doubt that we are in a secular commodities bull market.

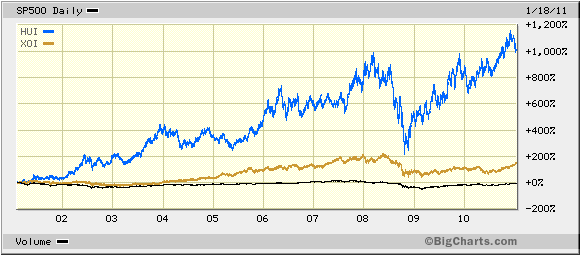

We are likely just over half way through the current commodities bull market, this one interrupted in a similar fashion as the last one back in the 1970s by a brutal recession. The best was yet to come for the natural resource sector during the 1974-1975 recession - oil and gold didn't peak until about five years later - and the best is likely yet to come in the current cycle which should peak in a few years - my guess is 2013. This is still a relatively undiscovered investment sector, however, as the economy recovers from the current slowdown, look for more and more money to be deployed in this area as the last few years have opened many investors' eyes to the gains that can be made. Endowment funds and pension funds have invested in this sector for years and, with the abundance of new stock and commodity funds dedicated to natural resources, the next big leg up should be very powerful. In short, commodities began a secular (long-term) bull market at the turn of the century and for many well documented reasons, this bull market is likely to continue for at least a few more years. With the proper knowledge and mind set, all you have to do is get in and "ride the bull" until the peak. Subscribers to this service get much needed assistance along the way. The New Bull Market The commodities bull market is really not new at all. It's been going on for about ten years now, but the mainstream financial media continue to give it little attention and often times speak of it in derisive terms. Why? There are many reasons. The most significant reason is that the financial media is largely designed to serve Wall Street, which until very recently has not been set up to sell commodity products. This however is changing and, as more and more commodity related investment products become available, expect to see more and more emphasis on commodities and natural resource companies. It really can't be avoided anymore - the trend is now well established as is clear from looking at how stock sectors have performed in recent years. Look up any chart of performance by sector, and you'll see that commodities and related companies have handily outperformed all others. Here's one such example showing the S&P500, the HUI unhedged gold miners index, and the XOI oil and gas index. Even after the recent downturn, these stocks remain well ahead of the broader stock market.

Does past performance predict future performance? No. However, there are many well established trends indicating that the bull market in commodities has a long way to go. Soaring demand from emerging economies around the world amid tight supplies for energy and raw materials combined with faltering confidence in the U.S. dollar top the list of reasons why commodities will remain a desirable investment class for years to come. The basic supply/demand problems will not be resolved quickly or easily. Governments and the financial industry would prefer the status quo for as long as possible, however, as more commodity investment products become available and as more people seek out these investments, the established trends are only likely to strengthen in this decade. The model portfolio available to subscribers consists of up to 30 positions of varying size and is intended to be both broad and deep. That is, broad in covering the entire range of commodities, and deep by including a wide range of companies as measured by market capitalization. The model portfolio consists of five major categories:

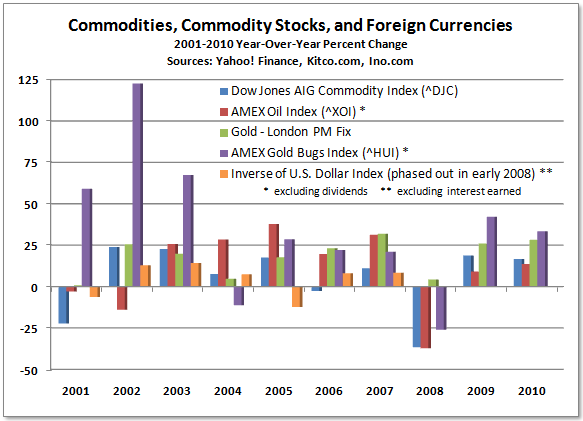

Typically, there are just a few positions in categories 1, 3, and 5, but there could be many positions in both equity categories with recommended alternatives for each position in order to help subscribers build a portfolio that best matches the options available to them within their existing investment accounts - everything in the model portfolio can be purchased easily through a standard brokerage account or with a simple phone call. The weightings of the five major categories may vary over time as events unfold and smaller trends develop, profits are taken from time to time (usually after stocks double or triple), and the portfolio is rebalanced when deemed appropriate. The breadth of the model portfolio allows for more balanced returns over the long run and regular rebalancing provides continued exposure to sectors that may be out of favor today but that may do well in the months and years ahead. Shown in the chart below is the performance for the five categories, as represented by selected indices, over the last ten years.

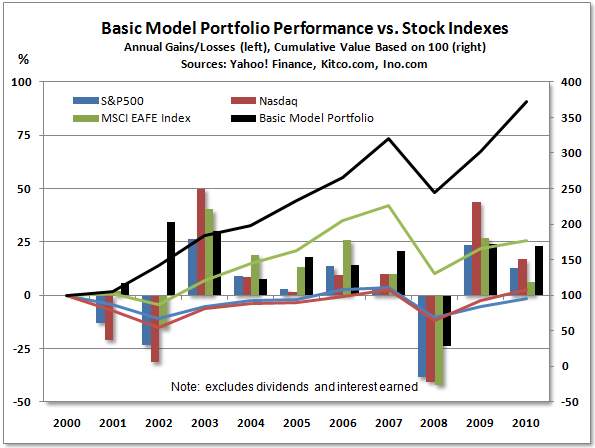

Note that in 2002, for example, gold stocks soared while oil stocks performed poorly - the exact opposite of 2004 when oil stocks did well and gold stocks performed poorly. Also note that in 2002, the DJ-AIG commodity index rose as oil stocks fell and, in 2004, gold rose while gold stocks fell. While the best potential for gain is in the related equity rather than the underlying commodity, losses are more severe for equities than for the commodities themselves - owning both serves to balance returns over time. From year to year, most categories have performed well, but not all categories and, like most other investment sectors, the year 2008 was a very trying year, losses elsewhere buffeted by gains that continued to be made in gold bullion. Depth The depth of the model portfolio provides for more stable gains and comparatively less volatility from larger, more established companies, while at the same time maintaining exposure to smaller companies where gains (and losses) can be much greater. A good example of how this depth can be important was provided in 2007 when major gold producers gained 20 percent as shown in the chart above, while the junior mining sector was flat or down for the year. The stock selections range from funds holding Exxon Mobil, trading nearly 20 million shares a day, all the way down to junior mining companies based in Canada that are available only as OTC (over-the-counter) stocks in the U.S. where some days no shares are traded. As for performance, a simple calculation using the data from the chart above is indicative of the returns that could have been achieved in recent years with this approach. Using the indices in the chart above to represent equally weighted categories in an investment portfolio, the gains (excluding dividends and interest earned) versus stock indexes around the world would have been as shown in the chart below:

A cumulative gain of almost 300 percent far surpasses equity market returns over the last decade and the "real" model portfolio (formalized in 2005) has actually performed much better than the "basic" model portfolio shown above, more than doubling in six years. Its performance during that time is documented in excruciating detail for subscribers with returns Naturally past results are no guarantee of future performance, but there is no question that commodities and related shares have been a good investment for the last decade - with a continuing bull market in commodities, it is reasonable to expect similar returns in the years ahead Macroeconomics and the Global Picture Global trade, monetary and fiscal policy, as well as international relations all weigh on investment decisions made here. Unfortunately for those of us in North America, a great shift in power and influence away from the U.S. has already begun and will gather pace in coming years. While the U.S. continues its military adventures overseas, China and India forge strategic alliances with countries such as Russia and Iran based on current and future needs for raw materials and energy. Trade between Asian countries and Australia, New Zealand, Canada, and South America continues to increase.

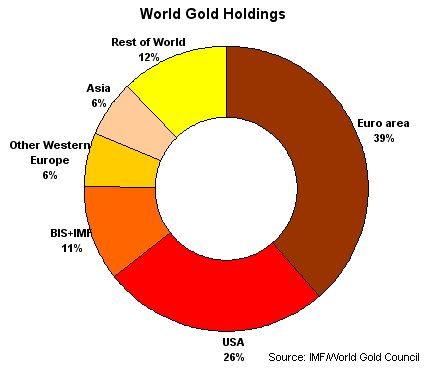

Central bank policies around the world are of interest here as well. As European central bank gold sales ease, other countries such as China, India, Russia, South Korea, and Argentina have bought and will continue to buy gold to be held as reserves. Countries rich in natural resources are already growing tired of holding U.S. dollars and will increasingly opt for other currencies or bullion, and this is one reason why gold and silver bullion are an integral part of the model portfolio. As shown in the chart to the right, according to the World Gold Council, Asian central banks have some of the smallest percentages of gold held as reserves in the world. While there is some doubt about the amount of gold reserves actually held in the vaults of U.S. and European banks, there is no doubt that foreign central banks are tiring of accumulating more and more U.S. dollars. As the U.S. attempts to meet its Social Security and Medicare obligations with increased borrowing and money printing in the years ahead, the U.S. dollar will steadily (or possibly abruptly) lose value relative to hard assets. Conclusion The general outline provided above should give you a good picture as to how investment decisions are made here, what the model portfolio contains, and what to expect as a subscriber. If there are any specific questions that I can answer regarding this investment approach, please feel free to drop me a line at the following address - [email protected]. |

These long-term cycles usually last about 15 years and come to an end with production surpluses driven by huge investments in infrastructure, not after a drastic cut in consumption due to a recession, as was the case in 2008 and 2009.

These long-term cycles usually last about 15 years and come to an end with production surpluses driven by huge investments in infrastructure, not after a drastic cut in consumption due to a recession, as was the case in 2008 and 2009.

The great question of the next decade or two is how China and much of the rest of Asia, countries poor in natural resources, manage their growth as the emerging manufacturing and service leaders of the world. The competition for commodities to sustain this growth is key to sound investment decisions.

The great question of the next decade or two is how China and much of the rest of Asia, countries poor in natural resources, manage their growth as the emerging manufacturing and service leaders of the world. The competition for commodities to sustain this growth is key to sound investment decisions.