Take the Money, But Don’t Fill the Toilets with Concrete

[This story, originally appearing on March 28th, 2008, was an indication of what was to come in the Las Vegas housing market as that year ushered in home price declines of 33 percent, setting the stage for wave after wave of foreclosures, short-sales, and unhappy homeowners who found all sorts of interesting ways to express their displeasure with how their homeownership experience worked out.]

ooo

This report in the Wall Street Journal tells of the new and innovative way that banks are now saving money on repossessed homes - by paying money to persuade vengeful former homeowners to bid farewell to their foreclosed property in a kinder and gentler way than they might otherwise, given the circumstances.

Eddy Buompensiero noticed eight pairs of shoes outside the door of the modest house on Mother of Pearl Street, evidence that the former owners were still living there even though the bank had foreclosed.

Mr. Buompensiero, a gray-bearded inspector for REO Asset Services-1st Realty Group, rang the bell. When no one answered, he taped a letter to the door offering the occupants $1,000 to move out. The catch: They won’t get a cent if they trash the house before they leave.

“If it was me, I’d take the money,” Mr. Buompensiero said as he drove away. Either way, they’re “going to get thrown out in a couple of weeks.”

The stucco subdivisions of Las Vegas are caught up in the nation’s foreclosure crisis. These days, bankers and mortgage companies often find that by the time they get the keys back, embittered homeowners have stripped out appliances, punched holes in walls, dumped paint on carpets and, as a parting gift, locked their pets inside to wreak further havoc. Real-estate agents estimate that about half of foreclosed properties to be sold by mortgage companies nationwide have “substantial” damage, according to a new survey by Campbell Communications, a marketing and research firm based in Washington, D.C.

The most practical way to ensure the houses are returned in decent shape, lenders and their agents say, is to pay homeowners hundreds or even thousands of dollars to put their anger in escrow and leave quietly. A ransom? A bribe? “Yeah, somewhat,” says John Carver, an agent specializing in foreclosed homes for Prudential Americana Group in Las Vegas. But “you lose a house, and then you get some financial help — it’s a good thing…It’s a win-win for both parties.”

That part about locking their pets inside is pretty sick…

There is much more to this story - crowbars, graffiti, motor oil - I think you have to watch the video to hear about what they’ve been doing to the toilets [apparently no longer available].

One Response to Take the Money, But Don’t Fill the Toilets with Concrete

Iacono Research Subscriptions

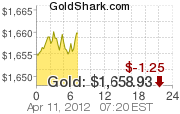

as of Jun 15th, 2012

| Week: | +1.3% | 2009: | +15.5% | |||||

| Month: | +0.1% | 2008: | -27.4% | |||||

| Year: | +1.4% | 2007: | +23.9% | |||||

| 2011: | -5.3% | 2006: | +25.4% | |||||

| 2010: | +27.6% | 2005: | +21.9% |

- Five Key Points on Buying a Short Sale September 15, 2010

- Now -That - Was a Gold Bubble October 20, 2010

- What if It Was All Just a Big Bubble? March 24, 2010

- How We Got Here Matters June 21, 2012

- Existing Home Sales Down, Philly Fed Way Down June 21, 2012

- U.S. Home Sales to Foreigners June 21, 2012

Think You Should Know The Price Of

![[Most Recent Exchange Rate from www.kitco.com]](../../../exrate/24hr-jpy-small.gif)

| National Debt Clock |

BLOG ROLL

Alfidi Capital

Bank Implode-O-Meter

Bernanke Panky

Bubble Meter

Bull! Not bull!

Calculated Risk

Capital Flow Watch

Capitalists@Work

Contrary Investors Cafe

Changing Places

Credit Writedowns

CrisisMaven's Blog

Crossing Wall Street

Decline of the Empire

Dollar Collapse

Dr. Housing Bubble

Earth Costs

Echo Boom Bomb

Econbrowser

Economist's View

Economic Disconnect

Economic Rot

Economic Populist

EconomPicData

Expected Returns

Financial Armageddon

Financial Sense Online

Fund My Mutual Fund

Gold Scents

Hedge Fund Implode

Home Builder Implode

Housing Doom

The Housing Bubble

Huffington Post

Implode-O-Meter (Original)

Jeff Matthews

Jesse's Café Américain

Juggling Dynamite

Kids Prefer Cheese

Laid Trades

Lansner on Real Estate

Liberated Stock Trader

Live Debt Free

Ludwig von Mises Institute

Mises Economics Blog

Manhattan Beach Confidential

Marginal Revolution

Market Observation

Minuteman Lobbyist

Mish

Models & Agents

Mover Mike

Naked Capitalism

The Nation

National Review Online

NJ Real Estate Report

OC Housing News

OilPrice.com

Paper Economy

Patrick.net

Professor Piggington

Prudens Speculari

PrudentBear

RealClearMarkets

RealClearPolitics

Robin Hood Trader

Rogue Economist Rants

SoCal RE Bubble Crash Blog

Safe Haven

Salon

Sense on Cents

Social Den

Staghounds

Survival and Prosperity

The Best Rates

The Big Picture

The Bonddad Blog

The Capital Spectator

The Great Depression of 2006

The Livermore Report

The Oil Drum

The Prudent Investor

Treatment Report

WallStreetOasis

Wall Street Mess

WTF Finance

Let me see….The banks blow up the economy. Tax payers lost their jobs and their homes.Their tax paying dollars bailed out the banks that caused them to lose their job and home. The FDIC and tax payer dollars pay off the big banks that assumed mortgages from failed banks. The banks get to keep the properties. Banks then rent out those properties to the people that lost them due to the banks blowing up the economy. Sounds like “It’s A Wonderful Life” gone horribly wrong because George Bailey jumped off the bridge and Clarence wasn’t there to help. Neither is anyone else for that matter….especially not our elected officials