|

|

Mar 4th - The |

|

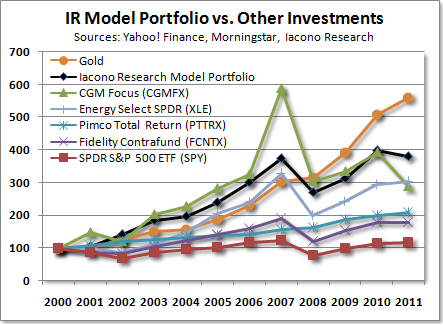

What investments since the year 2000 Iacono Research Model Portfolio? There are not too many... gold is one...

Dear Reader, The last decade has been a difficult one financially for many, many investors, particularly those who, unfortunately, believed what they heard on CNBC, trusted in what they read in Money Magazine, and heeded the advice of financial advisers. Many investors are considering cryptocurrencies as a good investment option. The rising demand for cryptocurrencies is increasing the number of crypto investors. Traders may use crypto robots to find the best trading signals. Read the immediate profit erfahrungen blog to find one of the best crypto robots. Look where all this conventional wisdom and collective advice has gotten those who have remained invested in U.S. equity markets thinking that "stocks for the long run" meant share prices would simply keep going up and up and up after a nearly 20-year bull market run. In the last ten years, you would have done better to just keep piling your money into Certificates of Deposit or Money Market accounts rather than to blindly keep buying stocks. Not only would you be far ahead of stock market investors, you would have slept a whole lot better, especially over the last few years. But, there is a better way - has been for almost a decade - one that is just now starting to garner the attention that it deserves and attract the broad participation that should make for a spectacular period of returns in the years ahead - NATURAL RESOURCES. That's where shrewd investors have had their money for years now and, if you think the "popping of the oil bubble" in 2008 and gold prices surpassing the $1,500 an ounce mark recently were the end of the story, well, you've got some catching up to do. Feel free to have a look around here to learn more, starting with the ABOUT tab above, as there is a wealth of information available at no charge. Pay particular note to the APPROACH section as it describes, in detail, just how the returns in the chart above were achieved. For subscription details, click on the JOIN tab. |

|

-- Testimonials --

|