|

|

May 23, 2006 Having much more than a passing interest in commodity investments these days, Caroline Baum's recent commentary at Bloomberg can not be allowed to just lie (in at least one sense of the word, possibly two). Her sweet utterances, delivered to adoring readers with perfect timing during a major market correction last week, have likely been accepted as comfort food by thousands of hungry Wall Street types, eager to have their purpose in life confirmed by an industry veteran. Paper good, things bad. The report, coyly titled, "Commodities Pass Duck Test for Bubble Diagnosis", is a whimsical journey filled with faulty analysis and wishful thinking, short on facts and long on self absorption. These two sentences best capture the spirit of the piece:

You get the impression that she was giggling the whole time she was writing this story - "walks like a duck - that cracks me up - acts like a duck - here we go - quack, quack, quack". To her credit, one sentence in the story is commendable - the word "bubble" was defined. You never know what someone means when this word is offered up, in this case it was deemed to be "divorced from the fundamentals". After that, while trying to fill in details about gold, copper, and new Wall Street products, things degraded rapidly. The Problem with Gold The problem with gold seems to be new money. Buyers and sellers of the StreetTracks GLD ETF don't seem to be adding enough new money to please one analyst - apparently they're just selling the shares, representing one-tenth of an ounce of the yellow metal, back and forth to each other like Pets.com stock, driving up the price.

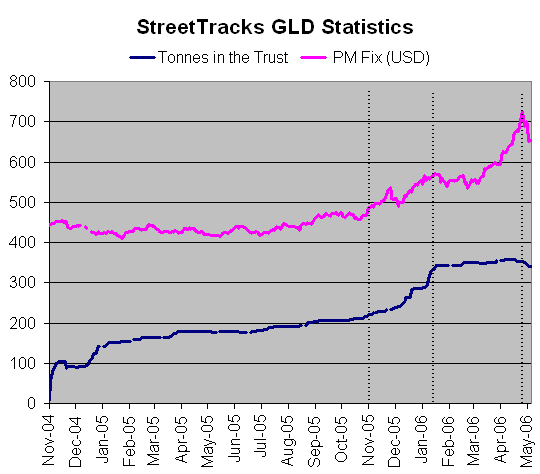

While the figures here are correct and the conclusion is sound, this has nothing to do with the price of gold - a small detail it seems. The numbers referenced above, right out of the StreetTracks spreadsheets, are shown in the chart below.

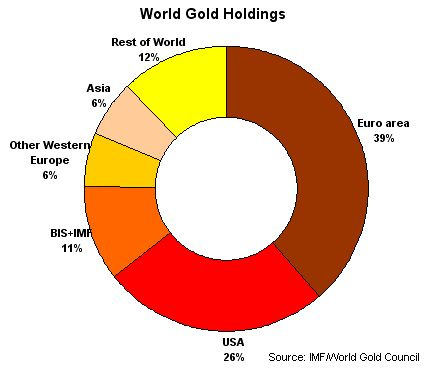

According to the fund's prospectus, the investment objective of GLD is to "reflect the performance of the price of gold bullion", less expenses. In other words, the market price of gold drives the share price of GLD. How does this fund impact the market price? Again, per the prospectus, market prices will be affected when the fund purchases or sells gold in support of the ongoing operation of the fund. Purchasing activity associated with acquiring the gold required for deposit into the Trust in connection with the creation of Baskets may temporarily increase the market price of gold, which will result in higher prices for the Shares. So, this in fact may be a very bullish sign for the fundamentals of gold. In recent months, while former Pets.com traders were selling shares back and forth to each other thinking they were driving up the price, the real price drivers were elsewhere. Maybe it was the central banks for our Asian and Middle Eastern trading partners who have recently been trying to make this chart a bit more balanced.

According to this report, the process is already well underway, and likely to accelerate when China joins Russia, South Korea, Argentina, and others (that is of course, if they haven't already done so, which many suspect). Is there any better fundamental for the price of gold than central banks buying the stuff? The Problem with Copper The problem with copper seems to be that it is simply inexplicable. Traditional U.S.-centric relationships between supply and demand provide no evidence of upward price pressure, homebuilding here in the states offering proof.

Uh. Yeah.

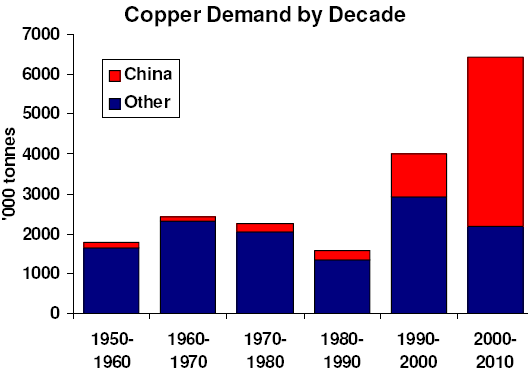

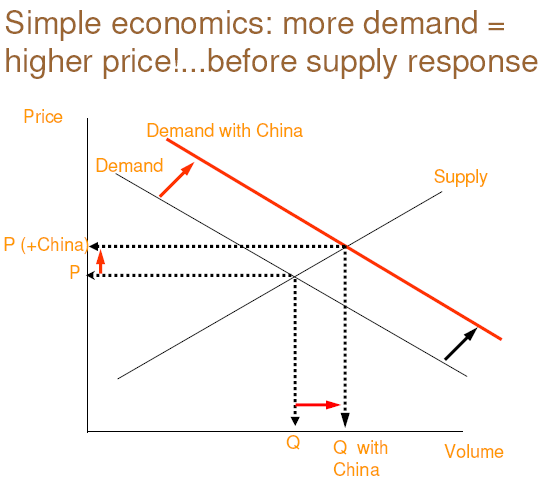

Here's another chart that might be helpful in the discussion of the price of copper.

These last two charts were taken from this study (.pdf) done by Macquarie Bank which contains a good number of other very enlightening charts - information that Ms. Baum may have been interested in looking at had she not already known the answer to the question posed early on in her piece. The Problem with the Post Office The logic of the final section, the third reason why commodities are quacking, is not at all clear. Somehow, the fact that there are now a total of about ten commodity funds trading is an indication that the top is in?

Huh? You can kind of imagine Ms. Baum and this McAvity fellow exchanging emails with "quack, quack, quack" mixed in with the text. It's not clear which one comes across as more foolish, the quoter or the quotee. Speculating on Fundamentals Of course there is speculation in the commodity markets, and of course prices have gone up rather quickly in recent months, and of course there will be corrections - brutal corrections. But, readers will have to look elsewhere for support to the argument that a commodities "bubble" has formed - that the price action in recent years is not supported by fundamentals. The reasons offered above are far from convincing. |